Paycheck Tax Calculator

Calculate Your Take-Home Pay After Taxes. For US Residents. Instantly for Free.

How Our Paycheck Calculator Works

💰 Gross Pay Calculation

Enter your hourly wage or annual salary, and we'll calculate your gross pay based on your selected pay frequency. Overtime is automatically calculated at time-and-a-half rates.

🏦 Tax Deductions

We calculate federal income tax using current IRS brackets, state taxes based on your location, and FICA taxes (Social Security and Medicare) at standard rates.

📈 Net Pay Result

Your take-home pay is calculated by subtracting all taxes and deductions from your gross pay. We provide a detailed breakdown so you understand every deduction.

All calculations are estimates based on current tax rates and should be used for planning purposes. Consult a tax professional for precise calculations.

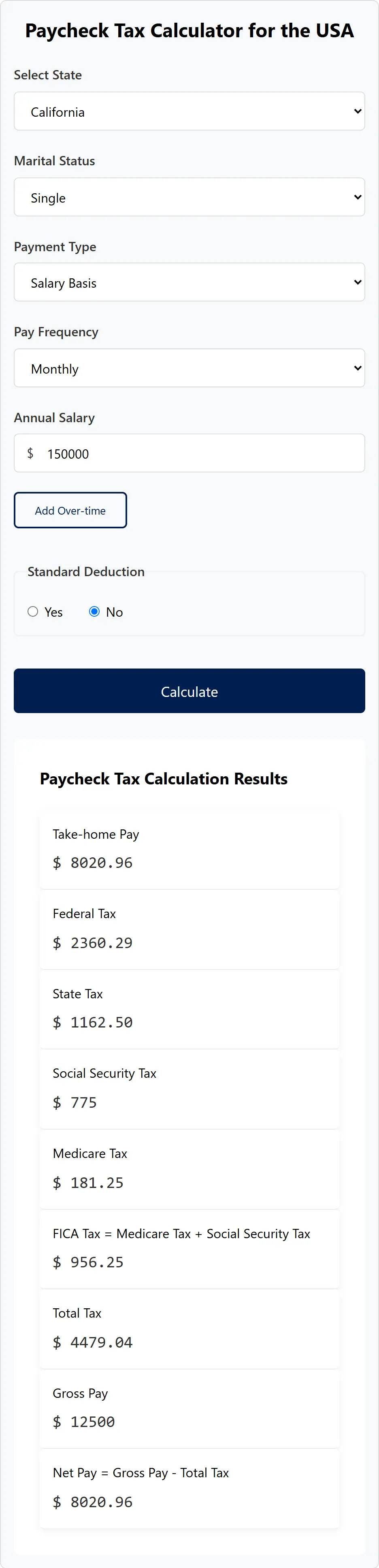

Paycheck Tax Calculator for the USA

Paycheck Tax Calculation Results

What is the Paycheck Tax Calculator?

A Paycheck Tax Calculator is a free online tool that calculates your take-home pay after taxes and deductions. The calculator uses gross pay, federal and state taxes, FICA taxes, and other deductions to estimate how much money is taken out from your paycheck.

It gives you a breakdown of your gross income (your total salary before taxes) and net income (your actual take-home pay after deductions).

If you've ever asked, "How much tax is taken out of my paycheck?", this calculator provides a quick, accurate answer based on your location, salary, and filing status.

How to Use the Paycheck Tax Calculator (Step-by-Step with Example)

Step-by-Step Instructions

Step 1: Choose Your State

Your state of residence determines whether and how

much state income tax applies.

Step 2: Select Marital Status

Your filing status—single

or married—affects your federal tax withholding and standard deduction.

Step 3: Pick Your Payment Type

Choose between:

- Hourly Basis – Enter hours worked and pay per hour.

- Salary Basis – Enter your total annual salary.

Step 4: Select Pay Frequency

Pick how often you get paid:

- Weekly

- Bi-weekly

- Semi-monthly

- Monthly

- Yearly

- Daily

Step 5: Input Your Pay Details

- If hourly: Fill in hours worked and hourly rate.

- If salaried: Fill in annual salary.

Step 6: Add Overtime (Optional)

If you work overtime, click "Add

Overtime" and enter your overtime hours and pay rate.

Step 7: Choose Standard Deduction

Select “Yes” or “No”

for using the standard deduction. Most users can leave this as-is.

Step 8: Click "Calculate"

The tool will break down:

- Gross pay

- Federal tax

- State tax

- Social Security & Medicare (FICA)

- Total tax

- Net (take-home) pay

Example Calculation

Let’s suppose you are:

- Single

- Living in California

- Paid monthly

- Earning $5,000/month

- No overtime

- Using standard deduction

After clicking Calculate, your results might look like this:

|

Category |

Amount |

|

Gross Pay |

$5,000.00 |

|

Federal Tax |

$600.00 |

|

State Tax |

$200.00 |

|

Social Security |

$310.00 |

|

Medicare |

$72.50 |

|

FICA Total |

$382.50 |

|

Total Tax |

$1,182.50 |

|

Net (Take-Home) Pay |

$3,817.50 |

What Is a Paycheck and How Is It Calculated?

A paycheck is the payment you receive from your employer for the work you’ve done during a specific pay period.

It usually comes in the form of a physical check or a direct deposit into your bank account. But the amount you actually take home—called your net pay—is typically less than your full salary or wages due to various deductions.

How a Paycheck Is Calculated:

Here’s a breakdown of how your paycheck is calculated step by step:

- Gross Pay

This is your total earnings before any taxes or deductions.

- For hourly employees:

Gross Pay = Hours Worked × Hourly Rate - For salaried employees:

Gross Pay = Annual Salary ÷ Number of Pay Periods (monthly, biweekly, etc.)

- Pre-Tax Deductions

These are amounts taken out before taxes are applied, which can lower your taxable income.

Examples:

- Health insurance premiums

- Retirement plan contributions (like 401(k))

- Flexible Spending Account (FSA) contributions

- Taxes

After pre-tax deductions, taxes are applied to your taxable income.

Common payroll taxes include:

- Federal income tax

Based on IRS tax brackets and your filing status (e.g., single or married) - State income tax

Varies by state—some states have flat rates, some are progressive, and others (like Florida and Texas) don’t tax income at all - Social Security tax

6.2% of your wages (up to a limit) - Medicare tax

1.45% of your wages (with an extra 0.9% for high earners)

- Post-Tax Deductions

These are taken after taxes and can include:

- Union dues

- Wage garnishments

- Charitable contributions

- Net Pay (Take-Home Pay)

This is the amount that actually comes in your bank account:

Net Pay = Gross Pay - (Pre-Tax Deductions) - Taxes - (Post-Tax Deductions)

Example:

Suppose you earn $2,000 gross every two weeks.

- Pre-tax 401(k) contribution: $100

- Federal tax: $200

- State tax: $50

- Social Security: $124

- Medicare: $29

- Post-tax deductions: $0

Net Pay = $2,000 - $100 - $200 - $50 - $124 - $29 = $1,497

How Taxes Are Deducted from Your Paycheck

When you receive your paycheck, the amount you see as net pay is whatever is left after taxes and deductions have been subtracted from your gross pay.

These deductions include federal, state, and local taxes, as well as other mandatory contributions like Social Security and Medicare.

Let’s break it down to understand how these taxes are deducted from your paycheck.

Federal Income Tax

The federal income tax is progressive, meaning the more you earn, the higher percentage of your income is taxed.

Your employer withholds this tax based on the information you provided on your W-4 form, such as your filing status (single, married, etc.) and number of dependents.

- How It’s Calculated:

The IRS provides tax brackets for different income levels, and your tax is calculated based on where your income falls within those brackets. - Withholding Method:

Employers use IRS tax tables to determine how much federal tax should be withheld from each paycheck.

State Income Tax

State income tax is similar to federal income tax but varies from state to state. Some states have a flat rate for all income levels, while others have progressive tax rates.

A few states, like Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming, don’t impose any state income tax at all.

- How It is Calculated:

If your state has an income tax, your employer will withhold based on the state’s tax rates and your income level. - Withholding Method:

Like federal taxes, employers typically use state-specific tax tables or formulas to determine the amount to withhold.

Social Security Tax

Social Security tax is a federal tax that funds the Social Security program, which provides benefits for retirees, disabled individuals, and survivors of deceased workers.

- Rate:

The Social Security tax rate is 6.2% of your taxable income (up to a certain income limit, which is $160,200 for 2025).

This means that, if you earn above this amount, you will stop paying Social Security tax for the remainder of the year.

- How It’s Calculated:

The tax is withheld from your paycheck automatically by your employer until you reach the annual income limit.

Medicare Tax

The Medicare tax helps fund the Medicare program, which provides health insurance for individuals aged 65 and older.

- Rate:

The Medicare tax rate is 1.45% of your taxable income, with no income limit—meaning it applies to all your earnings. - Additional Medicare Tax:

If you earn over $200,000 (single) or $250,000 (married), you are subject to an additional 0.9% Medicare tax on the amount above these thresholds.

Other Payroll Deductions

- Federal Unemployment Tax (FUTA):

Employers pay this tax on your behalf and it doesn't get deducted from your paycheck. It’s used to fund unemployment benefits. - State Unemployment Tax (SUTA):

Like FUTA, this is paid by your employer to fund state unemployment benefits. - Other Deductions:

Additional deductions can include:- Health insurance premiums

- Retirement contributions (e.g., 401(k) or 403(b) plans)

- Wage garnishments (for child support, debts, etc.)

- Flexible spending accounts (FSAs) or health savings accounts (HSAs)

Post-Tax Deductions

Some deductions are taken out after taxes have been calculated.

These could include:

- Union dues

- Charitable contributions

- Life insurance premiums

Example Breakdown of Deductions:

Let's assume you have a gross paycheck of $3,000.

|

Tax/Deduction |

Amount |

|

Federal Income Tax |

$300 |

|

State Income Tax |

$150 |

|

Social Security Tax |

$186 |

|

Medicare Tax |

$43.50 |

|

Total Deductions |

$679.50 |

|

Net Pay |

$2,320.50 |

Gross Pay vs. Net Pay: What’s the Difference?

Gross pay and net pay are the amounts you earn before and after deductions, and how each is calculated helps you understand your earnings and how much you take home.

Gross Pay: The Total Amount Before Deductions

Gross pay is the total amount of money you earn before any deductions, such as taxes, benefits, or retirement contributions, are subtracted.

It includes all the wages you are paid, including:

- Hourly wages or salary: The base pay you earn based on your hourly rate or annual salary.

- Overtime pays: Additional earnings for hours worked beyond the standard workweek (typically over 40 hours per week).

- Bonuses and commissions: Extra pay for performance or achieving specific targets.

- Tips: Additional payments made by customers in service-oriented jobs.

Gross pay is the amount mentioned in your employment contract or job offer and is used for tax calculations and benefits eligibility.

Example:

Suppose you have an annual salary of $50,000.

- Monthly gross pay: $4,166.67

- Weekly gross pay: $961.54

- Hourly gross pay (assuming 40 hours/week): $24.04

Net Pay: The Amount You Take Home

Net pay, also known as "take-home pay," is the amount you actually receive after all deductions are subtracted from your gross pay.

These deductions include:

- Federal income tax

- State income tax (if applicable)

- Social Security and Medicare taxes (FICA)

- Health insurance premiums

- Retirement contributions (401(k), pensions, etc.)

- Other deductions (union dues, wage garnishments, etc.)

Your net pay is the final amount that you see on your paycheck after all these deductions are made. It is the actual amount you have available to spend or save.

Example:

If your gross pay is $4,166.67 per month and deductions total $1,000 (for taxes, health insurance, and other deductions), your net pay will be:

- $4,166.67 (gross pay) - $1,000 (deductions) = $3,166.67 (net pay)

Key Differences Between Gross Pay and Net Pay

|

Aspect |

Gross Pay |

Net Pay |

|

Definition |

Total earnings before deductions |

Earnings after deductions |

|

What It Includes |

Base salary, hourly wages, overtime, bonuses, tips, etc. |

The amount left after taxes and other deductions are subtracted. |

|

Used For |

Tax calculations, determining salary or hourly rate |

Budgeting and personal finance planning |

|

What You Take Home |

No – it’s the total before deductions |

Yes – this is the actual amount you receive |

Federal Income Tax Brackets

The IRS tax brackets determine how much federal income tax is withheld from your paycheck based on your filing status and taxable income.

Here are the updated federal tax brackets for different filing statuses:

Single Taxpayer

|

Tax Rate |

Taxable Income From |

Up To |

|

10% |

$0 |

$11,600 |

|

12% |

$11,601 |

$47,150 |

|

22% |

$47,151 |

$100,525 |

|

24% |

$100,526 |

$191,950 |

|

32% |

$191,951 |

$243,725 |

|

35% |

$243,726 |

$609,350 |

|

37% |

$609,351 |

And up |

Married Filing Jointly or Qualifying Surviving Spouse

|

Tax Rate |

Taxable Income From |

Up To |

|

10% |

$0 |

$23,200 |

|

12% |

$23,201 |

$94,300 |

|

22% |

$94,301 |

$201,050 |

|

24% |

$201,051 |

$383,900 |

|

32% |

$383,901 |

$487,450 |

|

35% |

$487,451 |

$731,200 |

|

37% |

$731,201 |

And up |

Married Filing Separately

|

Tax Rate |

Taxable Income From |

Up To |

|

10% |

$0 |

$11,600 |

|

12% |

$11,601 |

$47,150 |

|

22% |

$47,151 |

$100,525 |

|

24% |

$100,526 |

$191,950 |

|

32% |

$191,951 |

$243,725 |

|

35% |

$243,726 |

$365,600 |

|

37% |

$365,601 |

And up |

Head of Household

|

Tax Rate |

Taxable Income From |

Up To |

|

10% |

$0 |

$16,550 |

|

12% |

$16,551 |

$63,100 |

|

22% |

$63,101 |

$100,500 |

|

24% |

$100,501 |

$191,950 |

|

32% |

$191,951 |

$243,700 |

|

35% |

$243,701 |

$609,350 |

|

37% |

$609,351 |

And up |

Explanation of the Tax Brackets:

- Taxable income is the amount of income you have left after deductions, exemptions, and credits are applied.

- The marginal tax rate applies to income in each bracket. For example, if you are a single taxpayer and earn $50,000, the first $11,600 will be taxed at 10%, the income between $11,601 and $47,150 will be taxed at 12%, and the remaining income will be taxed at 22%.

States with No Income Tax

These 8 states do not impose an income tax on residents:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Wyoming

States with a Flat Income Tax

These 15 states apply a single tax rate across all income levels:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Michigan

- Mississippi

- North Carolina

- Pennsylvania

- Utah

- Washington* (Applies to capital gains income of high-earning individuals)

States with a Progressive Rate Income Tax

These 27 states tax income based on different rates for different income levels:

- Alabama

- Arkansas

- California

- Connecticut

- Delaware

- Hawaii

- Kansas

- Maine

- Maryland

- Massachusetts

- Minnesota

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Wisconsin

Washington DC (federal district)

Federal and State Income Tax Withholding Explained

Key Tax Concepts You Should Know

Gross vs Net Pay

Gross pay is your total earnings before deductions. Net pay is what you actually receive after taxes and other deductions are subtracted.

FICA Taxes

Social Security (6.2%) and Medicare (1.45%) taxes are automatically deducted from all paychecks. These fund your future Social Security and Medicare benefits.

W-4 Form Impact

Your W-4 form tells your employer how much federal tax to withhold. Update it when you get married, have children, or buy a home to optimize your withholding.

State Tax Variations

Nine states have no income tax, while others have flat or progressive rates. Your location significantly impacts your take-home pay.

When you receive your paycheck, a portion of your earnings is withheld by your employer for federal and state income taxes. These amounts are deducted from your gross pay and sent directly to the government on your behalf.

What Is Tax Withholding?

Tax withholding is the process by which your employer deducts a portion of your earnings to cover your federal and state income taxes. This is done based on the amount you earn and the information you provide on your W-4 form (for federal taxes) or state withholding form (for state taxes).

These withholdings are then sent directly to the appropriate tax authorities – the IRS (Internal Revenue Service) for federal taxes and the state tax agency for state taxes.

Federal Income Tax Withholding

The federal income tax withheld from your paycheck is based on these factors:

- Filing Status: Whether you are single, married, or head of household will affect how much federal income tax is withheld.

- Income Level: The amount of federal tax withheld depends on your gross pay and your tax bracket. As your income increases, you may move into a higher tax bracket, which could result in more taxes being withheld.

- Allowances/Exemptions: The W-4 form allows you to claim allowances, which reduce the amount of income that is subject to withholding. The more allowances you claim, the less federal income tax will be withheld.

The IRS determines how much federal income tax should be withheld based on your pay and the allowances you claim.

Example:

If your gross pay is $4,000 per month, and you are filing as single with 1 allowance, the IRS will calculate how much tax to withhold based on your income and filing status.

State Income Tax Withholding

In addition to federal tax, most states also require state income tax withholding.

The rules for state income tax vary widely from state to state, and some states may not have an income tax at all. States with an income tax typically have their own withholding rates and methods, which may be different from federal tax withholding.

Here are some common state tax considerations:

- State Income Tax Rates: Some states have a flat income tax rate, meaning everyone pays the same percentage, while others use a progressive tax rate, similar to federal taxes, where the rate increases with income.

- State Withholding Forms: Just as you fill out a W-4 form for federal taxes; many states have their own forms for state tax withholding. These forms help your employer determine the amount to withhold based on your income and allowances.

For example, in California, the state uses a progressive tax system, so the more you earn, the higher the percentage of your income is taxed.

W-4 Form and Tax Withholding Adjustments

To ensure the correct amount of tax is withheld, you need to complete a W-4 form (for federal income tax) when you start a new job or if your circumstances change (e.g., marriage, having children, or getting a second job).

You can adjust your withholding by filing a new W-4 with your employer if needed.

The W-4 form asks for:

- Personal information: Such as your filing status and number of dependents.

- Allowances: The number of allowances you wish to claim (the more allowances, the less tax withheld).

- Extra withholding: If you want an additional amount withheld from each paycheck to cover taxes not accounted for in your withholding.

Adjusting your withholding ensures that you aren’t over- or under-paying taxes throughout the year. Under-withholding may result in owing taxes when you file your return while over-withholding could mean receiving a refund after filing your tax return.

Why Does Tax Withholding Matter?

Proper tax withholding makes sure that you don’t owe a large sum at tax time.

If you have too little withheld, you could face a large tax bill and potential penalties.

If you have too much withheld, you’ll receive a refund, but it means you’ve given the government an interest-free loan of your money.

Can You Adjust Your Withholding?

Yes, you can adjust your federal and state income tax withholding at any time during the year. If you believe too much or too little is being deducted, you can fill out a new W-4 form and submit it to your employer.

FICA Taxes: Social Security & Medicare

FICA (Federal Insurance Contributions Act) taxes are mandatory payroll taxes that fund two important programs in the United States: Social Security and Medicare.

These taxes are automatically withheld from your paycheck by your employer and provide financial support for retirement, disability, and healthcare for eligible people.

What are FICA Taxes?

FICA taxes are a combination of two parts:

- Social Security Tax

- Medicare Tax

These taxes are deducted from your gross income and are shared between you (the employee) and your employer. The FICA tax rate and the rules governing it are set by the federal government.

Social Security Tax

Social Security provides benefits for retirees, disabled individuals, and survivors of deceased workers.

- Rate: The Social Security tax rate is 2% for employees, and your employer also contributes an additional 6.2%, making the total Social Security tax rate 12.4%.

- Taxable Income Limit: Social Security taxes are only applied to income up to a certain limit, called the Social Security wage base. For 2025, this limit is $176,100 (subject to annual adjustments for inflation). This means that once you earn more than this amount during the year, you will no longer pay Social Security taxes on the income above this limit.

- Purpose: The Social Security program provides retirement benefits, disability insurance, and survivor benefits. As you contribute to the program through payroll taxes, you earn credits toward these benefits.

Medicare Tax

Medicare provides healthcare coverage for people aged 65 and older, as well as certain younger individuals with disabilities or specific medical conditions.

- Rate: The Medicare tax rate is 1.45% for employees, with your employer contributing an additional 1.45%, making the total Medicare tax rate 2.9%.

- No Income Limit: Unlike Social Security, there is no wage base limit for Medicare taxes. You will continue to pay Medicare taxes on your entire income.

- Additional Medicare Tax: If you earn over $200,000 in a year (for single filers) or $250,000 (for married couples filing jointly), you will be subject to an additional 0.9% Medicare tax on the income above these thresholds. This is known as the Additional Medicare Tax.

How FICA Taxes Are Calculated

FICA taxes are calculated based on your gross pay (before any deductions). Here’s how they are generally broken down:

- Social Security Tax: 6.2% of your gross pay, up to the Social Security wage base limit.

- Medicare Tax: 1.45% of your gross pay with no income limit.

If you earn $5,000 in one paycheck:

- Social Security Tax: 6.2% of $5,000 = $310

- Medicare Tax: 1.45% of $5,000 = $72.50

The total FICA tax withheld would be $310 + $72.50 = $382.50.

Employer’s Contribution

In addition to the amount withheld from your paycheck, your employer also contributes to FICA taxes. For every dollar you pay in FICA taxes, your employer matches the amount:

- 6.2% for Social Security (up to the wage base limit)

- 1.45% for Medicare (no income limit)

So, while you pay 7.65% in FICA taxes (6.2% for Social Security + 1.45% for Medicare), your employer also contributes 7.65%, bringing the total FICA tax rate to 15.3% (6.2% + 6.2% for Social Security + 1.45% + 1.45% for Medicare).

FICA Tax Example

Let’s assume a monthly salary of $6,000:

- Social Security Tax: 6.2% of $6,000 = $372

- Medicare Tax: 1.45% of $6,000 = $87

- Total FICA Taxes: $372 (Social Security) + $87 (Medicare) = $459

So, $459 will be withheld from your paycheck for FICA taxes, and your employer will contribute an additional $459.

Can You Opt Out of FICA Taxes?

Generally, no. Most employees are required to pay FICA taxes. However, certain groups may be exempt, including:

- Religious groups: Some religious organizations may be exempt from Social Security and Medicare taxes if they meet specific criteria.

- Students: Certain students working at a school may not be required to pay FICA taxes.

- Nonresident aliens: If you are a nonresident alien working in the U.S., you may not be subject to FICA taxes.

How FICA Taxes Impact Your Benefits

Your contributions to Social Security and Medicare determine your eligibility for benefits:

- Social Security Benefits: The more you pay into Social Security (through FICA taxes), the more credits you accumulate. To qualify for Social Security retirement benefits, you generally need to earn 40 credits, which equates to about 10 years of work.

- Medicare Benefits: You are automatically eligible for Medicare at age 65 if you’ve worked and paid into the system for at least 10 years. If you haven’t worked enough, you may still be able to purchase Medicare coverage.

Pay Frequency and Its Impact on Your Net Pay

Pay frequency refers to how often you receive your paycheck. The frequency with which you are paid impacts your net pay. The more frequently you are paid, the more often taxes and other deductions are withheld from your paycheck.

Here’s a breakdown of the different pay frequencies and how they can affect your net pay:

Common Pay Frequencies

- Weekly: Employees are paid every week (52 pay periods per year).

- Biweekly: Employees are paid every two weeks (26 pay periods per year).

- Semimonthly: Employees are paid twice a month (24 pay periods per year).

- Monthly: Employees are paid once a month (12 pay periods per year).

How Pay Frequency Affects Your Tax Withholding

The frequency of your pay also affects how your tax withholding is calculated. Employers must adjust your withholding each period to ensure that the correct amount of taxes is withheld by the end of the year. Here’s how different pay frequencies influence tax deductions:

- Weekly Pay:

- More frequent withholding: Since you’re paid weekly, tax withholdings are divided into smaller amounts each week. Your taxes (like federal income tax, Social Security, and Medicare) are calculated based on your weekly gross pay, which means each paycheck will have a slightly smaller amount of tax withheld.

- Biweekly Pay:

- Moderate withholding frequency: With 26 pay periods in a year, your tax withholding is spread out across 26 paychecks. The withholding per paycheck is slightly higher than if you were paid weekly, but it's still broken down over a fairly frequent schedule.

- Semimonthly Pay:

- Less frequent withholding: In a semimonthly pay system (twice a month), your tax withholding may be slightly higher per paycheck compared to weekly or biweekly. This is because the taxes are spread across fewer paychecks (24 per year). You might also see some variations in the amount deducted due to the different ways payroll is structured for semimonthly schedules.

- Monthly Pay:

- Lowest withholding frequency: In this case, you are paid only 12 times a year. While this means you receive larger paychecks, it also means that taxes are withheld in larger chunks each month. If your employer uses a monthly pay schedule, the amount withheld from each paycheck could be higher, and you might also feel the pinch of taxes being taken out in larger sums.

How Pay Frequency Affects Other Deductions

Aside from taxes, several other deductions may be taken from your paycheck, such as:

- Health insurance premiums

- Retirement contributions (e.g., 401(k), pension)

- Union dues

- Child support or wage garnishments

Most of these deductions are typically calculated on a per-paycheck basis. So, if you are paid more frequently, you may notice smaller deductions from each paycheck, but the total deductions for the year remain the same.

For example:

- If you contribute $300 per month to your 401(k), you will see a $300 deduction from your paycheck each month. However, if you are paid biweekly, the same $300 annual contribution will be split into two $150 deductions.

How Pay Frequency Affects Net Pay

The main effect of pay frequency on your net pay is the amount of withholding per paycheck. While your annual salary doesn’t change based on how often you are paid, the smaller the pay period, the smaller your net pay per paycheck.

Here’s an example to illustrate:

Let’s assume you earn $60,000 per year, and your payroll deductions are as follows:

- Federal income tax: $10,000

- State income tax: $3,000

- FICA taxes (Social Security + Medicare): $4,590

- Health insurance premium: $2,400

- 401(k) contribution: $3,600

The total deductions amount to $23,590.

Weekly Pay Example:

- Gross pay per week: $60,000 ÷ 52 weeks = $1,153.85

- Total deductions per week: $23,590 ÷ 52 weeks = $453.27

- Net pay per week: $1,153.85 - $453.27 = $700.58

Biweekly Pay Example:

- Gross pay per biweekly period: $60,000 ÷ 26 periods = $2,307.69

- Total deductions per biweekly period: $23,590 ÷ 26 periods = $906.54

- Net pay per biweekly period: $2,307.69 - $906.54 = $1,401.15

Semimonthly Pay Example:

- Gross pay per semimonthly period: $60,000 ÷ 24 periods = $2,500

- Total deductions per semimonthly period: $23,590 ÷ 24 periods = $982.92

- Net pay per semimonthly period: $2,500 - $982.92 = $1,517.08

Monthly Pay Example:

- Gross pay per month: $60,000 ÷ 12 months = $5,000

- Total deductions per month: $23,590 ÷ 12 months = $1,965.83

- Net pay per month: $5,000 - $1,965.83 = $3,034.17

Which Pay Frequency Is Best for You?

The choice of pay frequency often depends on personal preferences and budgeting needs. Here’s a quick comparison:

- Weekly pay is helpful if you need more frequent access to your earnings and prefer budgeting on a short-term basis.

- Biweekly pay offers a balance between frequency and amounts withheld, making it the most common pay schedule.

- Semimonthly and monthly pay may result in larger deductions per paycheck but fewer pay periods to manage.

How to Maximize Your Take-Home Pay

Maximizing your take-home pay (the amount you take home after taxes and deductions) means that you’re getting the most out of your earnings. While you can't control certain factors like tax rates and Social Security contributions, there are several strategies you can implement to boost your net pay and reduce the amount that is withheld from your paycheck.

Here are some key strategies to maximize your take-home pay:

Adjust Your Tax Withholdings

One of the most effective ways to increase your take-home pay is by adjusting the amount of federal tax that is withheld from your paycheck.

- Update your W-4: The W-4 form determines how much federal

income tax your employer withholds from your paycheck. You can adjust your withholding

allowances to reduce the amount withheld from each paycheck. The more allowances

you claim, the less tax is withheld.

- Claim more allowances: If you have dependents or deductions (like mortgage interest), you might be able to claim more allowances, reducing the withholding amount.

- Consider the IRS Tax Withholding Estimator: This tool can help you determine the right amount of withholding and prevent over-withholding or under-withholding.

Note: While claiming more allowances can increase your take-home pay, it might also mean a smaller refund when you file your taxes. Ensure you don't underpay and end up with a large tax bill at the end of the year.

Contribute to Pre-Tax Benefits

Pre-tax benefits can reduce your taxable income, which in turn reduces the amount of income tax withheld from your paycheck.

- 401(k) Contributions: Contributing to a 401(k) or similar retirement plan reduces your taxable income. For example, if you contribute $5,000 to your 401(k), your taxable income for the year is reduced by $5,000, lowering the amount of tax withheld.

- Health Savings Account (HSA) or Flexible Spending Account (FSA): Contributions to an HSA or FSA are tax-deductible. By contributing to these accounts, you can reduce your taxable income, and the money is used tax-free for eligible medical expenses.

- Commuter Benefits: Some employers offer pre-tax commuter benefits, allowing you to pay for parking, transit, or vanpooling with pre-tax dollars, which reduces your taxable income.

Take Advantage of Employer Benefits

Many employers offer benefits that can reduce your overall tax burden and increase your take-home pay. Here are a few examples:

- Employer Health Insurance: Health insurance premiums deducted from your paycheck are typically taken out pre-tax, lowering your taxable income.

- Life Insurance: Some employers offer group life insurance as a benefit, and premiums for these plans are often deducted from your paycheck pre-tax.

- Dependent Care Benefits: If your employer offers a dependent care FSA, you can contribute pre-tax dollars to cover daycare costs for children or dependents, reducing your taxable income.

Maximize Tax Deductions

Tax deductions directly reduce your taxable income, which can lower your overall tax liability.

Consider the following:

- Itemize Your Deductions: If your total eligible deductions (e.g., mortgage interest, medical expenses, and charitable donations) exceed the standard deduction, you can itemize to reduce your taxable income.

- Charitable Contributions: Donating to qualified charities can reduce your taxable income. Keep track of your donations to take advantage of this deduction.

Consider Your Filing Status

Your filing status can impact on your tax rate. Review your filing status annually and consider the following:

- Married Filing Jointly vs. Filing Separately: If you’re married, filing jointly might offer better tax benefits than filing separately.

- Head of Household: If you’re a single parent or primary caregiver, filing as Head of Household can provide a better tax rate and higher standard deductions compared to filing as a Single.

Reduce Your Taxable Income with Tax Credits

Tax credits directly reduce your tax liability, often providing a greater benefit than deductions.

Some examples include:

- Child Tax Credit: If you have children under 17, you may qualify for a child tax credit, which can significantly reduce your tax bill.

- Earned Income Tax Credit (EITC): If you’re a low- or moderate-income worker, you might qualify for the EITC, a refundable credit that can increase your tax refund.

- Education Credits: If you or a dependent is pursuing higher education, you may be eligible for education-related tax credits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit.

Maximize Your Retirement Contributions

In addition to contributing to your employer’s 401(k), you may be able to contribute to other retirement accounts to reduce your taxable income:

- IRA (Individual Retirement Account): Contributing to a traditional IRA can reduce your taxable income, depending on your income level and other eligibility factors.

- Roth IRA: Although Roth IRA contributions are made with after-tax dollars, qualified withdrawals are tax-free. While this won’t immediately reduce your taxable income, it can still benefit your long-term financial goals.

FAQs

What is the difference between biweekly and semi-monthly pay?

Biweekly: Paid every two weeks (26 times a year). Semi-monthly: Paid twice a month (24 times a year).

Are bonuses and overtime taxed differently?

Yes, bonuses and overtime are generally taxed at a higher rate than regular income due to supplemental withholding rates.

What if I’m exempt from federal withholding?

If you're exempt, no federal income tax will be withheld from your paycheck, but other taxes (like Social Security and Medicare) may still apply.

What is FUTA and who pays it?

FUTA (Federal Unemployment Tax Act) is a tax paid by employers to fund unemployment benefits, not deducted from employees’ paychecks.

How does health insurance affect my paycheck?

Health insurance premiums are usually deducted from your paycheck pre-tax, reducing your taxable income.

Is my paycheck amount the same every period?

Not always. It can vary if you work overtime, receive bonuses, or have deductions like retirement contributions or garnishments.

How do local taxes affect my paycheck?

Local taxes are deducted based on where you live or work and may include city, county, or state taxes.

Should I claim single or head of household?

Claim Head of Household if you’re unmarried and support a dependent. It offers a higher standard deduction.

What if my paycheck is wrong or missing?

Contact your HR or payroll department immediately to resolve any discrepancies.

Privacy, Accuracy, and Accessibility

- Free to use: Our paycheck calculator is completely free and easy to use.

- No data saved: We do not save any of your data or inputs. Your privacy is important to us.

- No sign-up required: You can use the calculator without needing to sign up or create an account.

- Not 100% accurate: The results are estimates and should not be relied upon 100%. For precise calculations, consult a tax professional.

References

- Federal income tax rates and brackets | Internal Revenue Service. (n.d.). https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

- Topic no. 751, Social Security and Medicare withholding rates | Internal Revenue Service. (n.d.). https://www.irs.gov/taxtopics/tc751

- Yushkov, A. (2025, March 11). 2025 State Income tax Rates and brackets | Tax Foundation. Tax Foundation. https://taxfoundation.org/data/all/state/state-income-tax-rates/

- Yushkov, A. (2025, February 18). 2024 State income tax Rates and brackets | Tax Foundation. Tax Foundation. https://taxfoundation.org/data/all/state/state-income-tax-rates-2024/

- Vermeer, T. (2025, February 18). 2023 State income tax Rates and brackets | Tax Foundation. Tax Foundation. https://taxfoundation.org/data/all/state/state-income-tax-rates-2023/